Choosing the Best Billing Software for PC 2025 from Made in India

Introduction to Billing Software

In today’s rapidly evolving business environment, efficient and accurate billing is crucial. Managing Goods and Services Tax (GST) compliance is a significant aspect of financial operations, and the right billing software can streamline this process. Billing software for PCs offers a reliable solution to manage invoices, taxes, and financial records, all while ensuring GST compliance. This guide will delve into the importance of billing software, its key features, how to choose the right software, and its benefits for businesses.

Table of Contents

| Section | Headings/Subheadings |

|---|---|

| 1. | Introduction to Billing Software |

| 2. | Why Billing Software is Essential |

| 3. | Key Features of Billing Software |

| 4. | Choosing the Right Billing Software for Your Business |

| 4.1 | Ease of Use |

| 4.2 | Scalability |

| 4.3 | Integration Capabilities |

| 4.4 | Cost |

| 4.5 | Customer Support |

| 5. | Benefits of Using Billing Software |

| 6. | Common Challenges in GST Accounting and How Billing Software Solves Them |

| 6.1 | Manual Errors |

| 6.2 | Compliance Risks |

| 6.3 | Data Management |

| 6.4 | Time-Consuming Processes |

| 7. | How to Implement Billing Software |

| 7.1 | Identify Your Requirements |

| 7.2 | Choose the Right Software |

| 7.3 | Set Up the Software |

| 7.4 | Train Your Team |

| 7.5 | Monitor and Optimize |

| 8. | Expert Insights on Billing Software |

| 9. | Future Outlook on Billing Software |

| 10. | Conclusion |

Why Billing Software is Essential

Billing software is indispensable for businesses of all sizes. It automates the complex processes of invoice generation, GST calculation, filing, and reporting, ensuring compliance with government regulations. The software minimizes human error, reduces the time spent on manual calculations, and provides real-time insights into a company’s financial health.

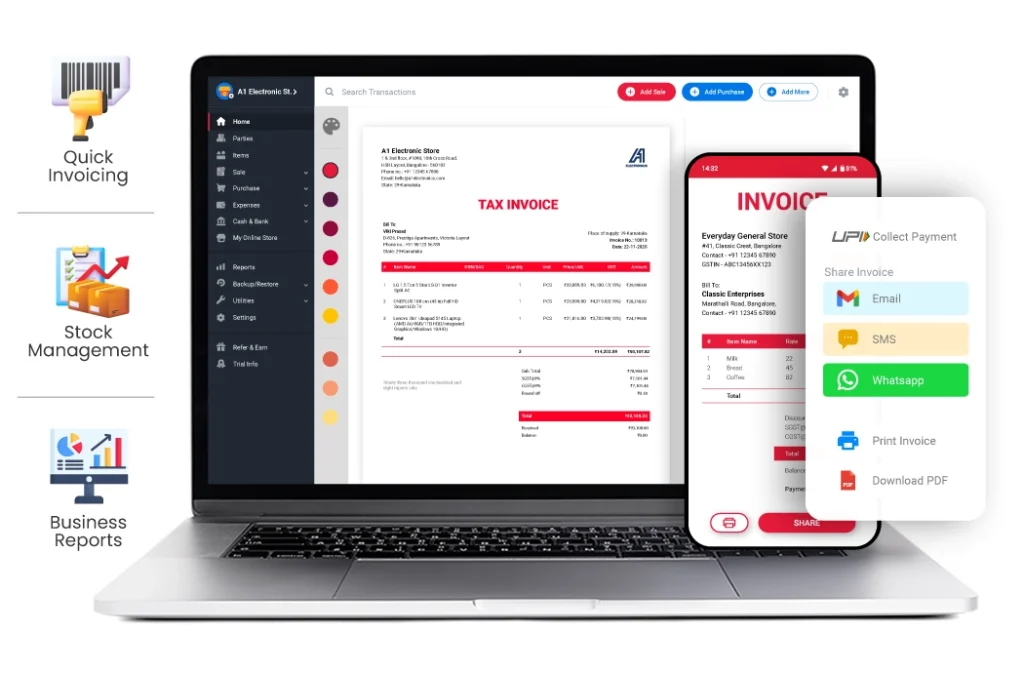

Key Features of Billing Software

- Automated GST Calculation: Automatically calculate GST based on the latest tax rates, ensuring accuracy and compliance.

- Invoice Management: Generate, manage, and track GST-compliant invoices with ease.

- Tax Filing: Simplify the process of filing GST returns with integrated e-filing capabilities.

- Financial Reporting: Access detailed reports on your financial activities, including GST liabilities, sales, and purchases.

- Multi-User Access: Collaborate with your team by providing secure, multi-user access to the software.

- Data Security: Ensure that your financial data is protected with robust security measures.

Choosing the Right Billing Software for Your Business

Selecting the right billing software is a critical decision for any business. The software you choose should align with your business needs and scale as your operations grow. Below are key factors to consider:

1. Ease of Use

The software should have a user-friendly interface, allowing users with varying levels of technical expertise to navigate and utilize its features effectively.

2. Scalability

Choose software that can grow with your business. It should handle increasing transaction volumes and expand to accommodate additional features as your business evolves.

3. Integration Capabilities

The ability to integrate with other software, such as inventory management or payroll systems, is crucial for seamless operations.

4. Cost

Consider the total cost of ownership, including any subscription fees, setup costs, and additional charges for upgrades or support.

5. Customer Support

Reliable customer support is essential. Ensure that the software provider offers prompt and effective support to resolve any issues you may encounter.

Benefits of Using Billing Software

Implementing billing software offers numerous advantages, including:

- Accuracy: Reduce errors associated with manual GST calculations and filings.

- Time-Saving: Automate routine billing tasks, allowing you to focus on core business activities.

- Compliance: Ensure that your business adheres to the latest GST regulations with automatic updates.

- Financial Transparency: Gain a clear view of your financial status through comprehensive reports and dashboards.

- Cost-Effectiveness: Lower administrative costs by reducing the need for extensive manual bookkeeping.

Common Challenges in GST Accounting and How Billing Software Solves Them

1. Manual Errors

Manual data entry can lead to significant errors in GST calculation and reporting. Billing software eliminates these errors by automating the process.

2. Compliance Risks

Staying up-to-date with changing GST laws is challenging. Billing software ensures compliance by updating automatically with the latest tax laws and regulations.

3. Data Management

Managing large volumes of financial data manually is cumbersome. Billing software provides organized data storage and easy retrieval, ensuring efficient data management.

4. Time-Consuming Processes

Traditional accounting methods are time-consuming and labor-intensive. Automating these processes with billing software saves time and reduces the workload on your team.

How to Implement Billing Software

1. Identify Your Requirements

Assess your business needs to determine which features are essential for your billing software.

2. Choose the Right Software

Based on your requirements, select the software that best meets your needs. Consider factors such as ease of use, scalability, integration, and cost.

3. Set Up the Software

Install the software on your PC and configure it according to your business needs. Import existing financial data if necessary.

4. Train Your Team

Ensure that your team is adequately trained to use the software. Provide comprehensive training sessions and access to user manuals or tutorials.

5. Monitor and Optimize

Regularly monitor the software’s performance and optimize its use to ensure that you are getting the most out of your investment.

Expert Insights on Billing Software

Experts in the field of financial technology emphasize the importance of choosing billing software that is not only user-friendly but also capable of handling complex GST calculations. Many recommend opting for software that offers regular updates to stay compliant with changing tax laws.

Future Outlook on Billing Software

The future of billing software is likely to see advancements in AI-driven automation, making the process even more efficient. Features like predictive analytics, which forecast financial trends, could become standard, offering businesses deeper insights into their financial health.

Conclusion

Incorporating billing software into your business operations is a smart move that can save time, reduce errors, and ensure compliance with GST regulations. By choosing the right software and implementing it effectively, you can streamline your accounting processes and gain valuable insights into your financial health and get success in Business.

Download Now for PC

- Keywords: billing software, GST compliance, invoice management, financial reporting, business software you search here.